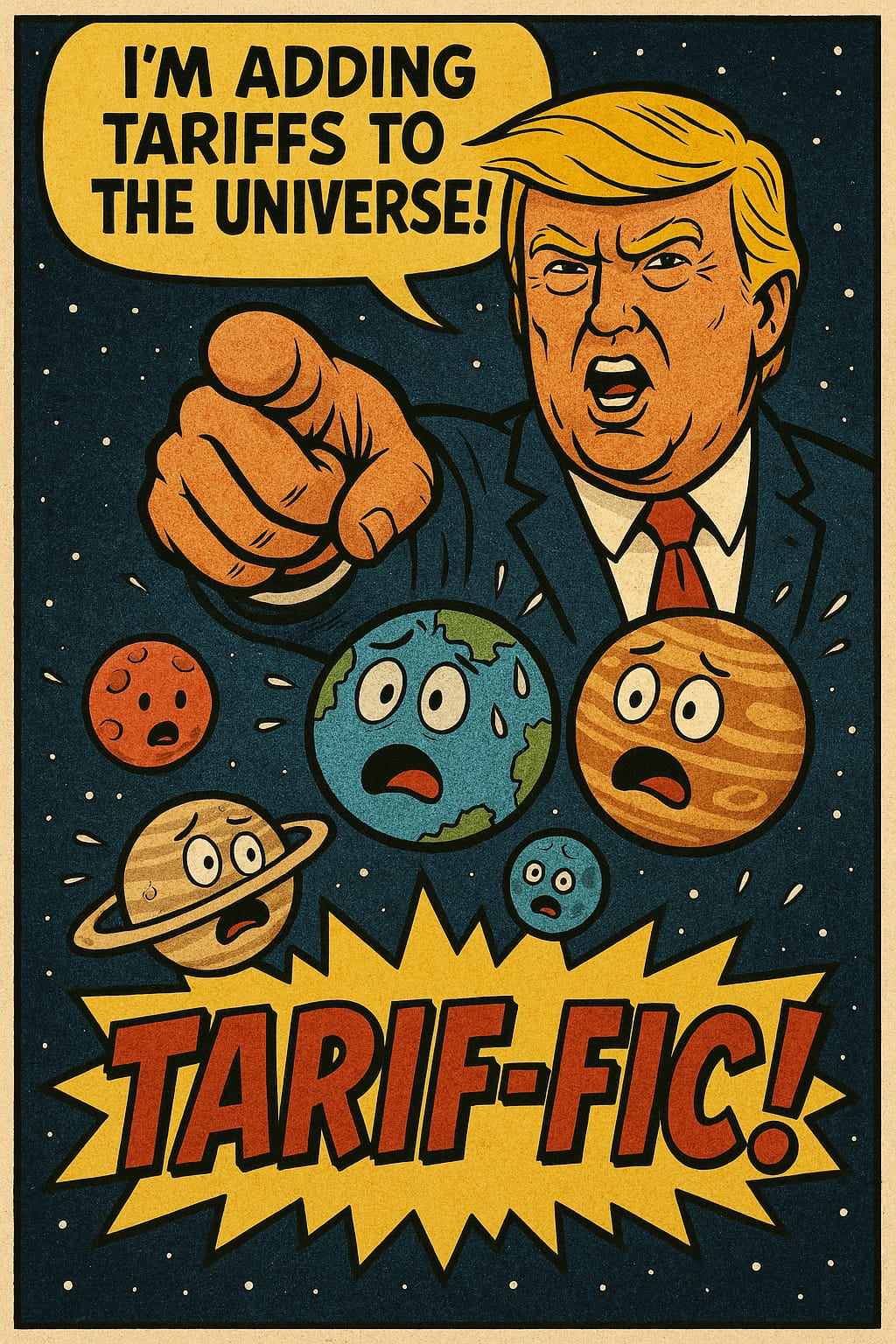

Trump's Tariff Escalation Sparks Global Trade Tensions

Dubbed "Liberation Day" by Trump, April 2, 2025, marked the implementation of reciprocal tariffs aimed at addressing what his administration calls "unfair trade practices."

Apr 04, 2025

In a dramatic escalation of protectionist policies, former U.S. President Donald Trump has reignited global trade tensions with sweeping tariffs targeting major trading partners, including China, Canada, Mexico, and the European Union. Dubbed "Liberation Day" by Trump, April 2, 2025, marked the implementation of reciprocal tariffs aimed at addressing what his administration calls "unfair trade practices." These measures have sent shockwaves through global markets and drawn sharp criticism from both domestic industries and international governments.

A Second Wave Of Protectionism

Trump's second term has been characterized by an aggressive push to reshape U.S. trade policy. While his first administration imposed tariffs on approximately $380 billion worth of imports, the current measures are projected to exceed $1.4 trillion by April 2025. These policies include a 25% global tariff on steel and aluminum imports, a 20% tariff on all Chinese goods, and a 25% tariff on most Canadian and Mexican products.

The administration has framed these actions as a means to bolster domestic manufacturing, curb illegal immigration, and combat contraband drug trafficking. However, critics argue that these tariffs could harm American consumers and businesses by driving up costs and disrupting supply chains.

Steel And Aluminum: A Renewed Focus

On March 12, 2025, the U.S. imposed 25% tariffs on all steel and aluminum imports, eliminating exemptions that had been in place during Trump's first term. The administration justified the move by claiming that previous exemptions created loopholes exploited by countries with excess production capacity, such as China.

These measures have drawn sharp rebukes from allies like Canada and the European Union, which have announced counter-tariffs in response. Canada, the largest supplier of aluminum to the U.S., has warned that these tariffs could severely impact its economy. Meanwhile, domestic industries reliant on imported metals have expressed concerns about rising costs and supply shortages.

Auto Industry In The Crosshairs

The North American auto industry has also been significantly affected. In January 2025, Trump announced tariffs targeting Canadian and Mexican auto imports, threatening the highly integrated supply chain that has developed over decades of free trade agreements. Automakers like Ford and General Motors have lobbied for exemptions, warning that these tariffs could hurt American companies more than their foreign competitors.

Despite these warnings, a 25% tariff on all imported cars took effect on April 3, with additional tariffs on non-U.S. content in domestically assembled vehicles set to follow in May. The White House argues that these measures will boost domestic manufacturing and generate $100 billion in tax revenue.

China's Retaliation: A Brewing Trade War

China has been a primary target of Trump's tariff policies. On February 1, 2025, he signed an executive order imposing a 10% tariff on all Chinese imports, which was later raised to 20% in March. In response, China has implemented its own tariffs on U.S. goods, including agricultural products like soybeans and wheat. Beijing has also launched investigations into American companies and restricted exports of critical materials such as tungsten.

While Trump's administration claims these measures are necessary to address China's trade surplus with the U.S., analysts warn that they could exacerbate tensions between the world's two largest economies. A report by UBS economists suggests that higher tariffs could slow China's GDP growth by up to 1.5 percentage points over the next year.

Market Reactions And Economic Uncertainty

The announcement of reciprocal tariffs has created significant economic uncertainty. Stock markets have experienced volatility as investors grapple with the potential implications of a prolonged trade war. ING Group noted that the lack of clarity surrounding Trump's tariff plans has further fueled market instability.

Domestically, businesses reliant on global supply chains are bracing for higher costs. Retailers like Walmart and Costco have already begun pressuring Chinese suppliers to lower prices to offset the impact of tariffs.

Historical Context: A Return To Protectionism?

Trump's tariff policies mark a significant departure from decades of free trade agreements aimed at liberalizing global commerce. Historically, Republican administrations have used protectionist measures to support American industries, a trend Trump revived during his first term. Critics argue that these policies could undermine global trade relationships and harm the very industries they aim to protect.

Despite these concerns, Trump's administration remains steadfast in its commitment to reshaping U.S. trade policy. Commerce Secretary Howard Lutnick has defended the tariffs as necessary for achieving "fair trade" and addressing long-standing imbalances with key trading partners.

Global Implications

The ripple effects of Trump's tariffs are being felt worldwide. Countries like Canada and the European Union have announced counter-tariffs, while others are seeking diplomatic solutions to avoid further escalation. Meanwhile, China's economy faces additional pressure from reduced exports and deflationary risks exacerbated by the new tariffs.

As tensions mount, economists warn that a full-blown trade war could have far-reaching consequences for global economic stability. The International Monetary Fund (IMF) has urged nations to resolve disputes through dialogue rather than unilateral actions.

Trump's tariff policies represent a high-stakes gamble with uncertain outcomes. While they aim to address perceived inequities in global trade, their broader implications, ranging from disrupted supply chains to strained international relations, cannot be ignored.

As "Liberation Day" ushers in a new era of protectionism, the world watches closely to see whether these measures will achieve their intended goals or lead to unintended consequences for the global economy.